In the past insurers would price your health insurance based on any number of factors but after the affordable care act the number of variables that impact your health insurance costs have been.

Average yearly home insurance premium.

Here are the.

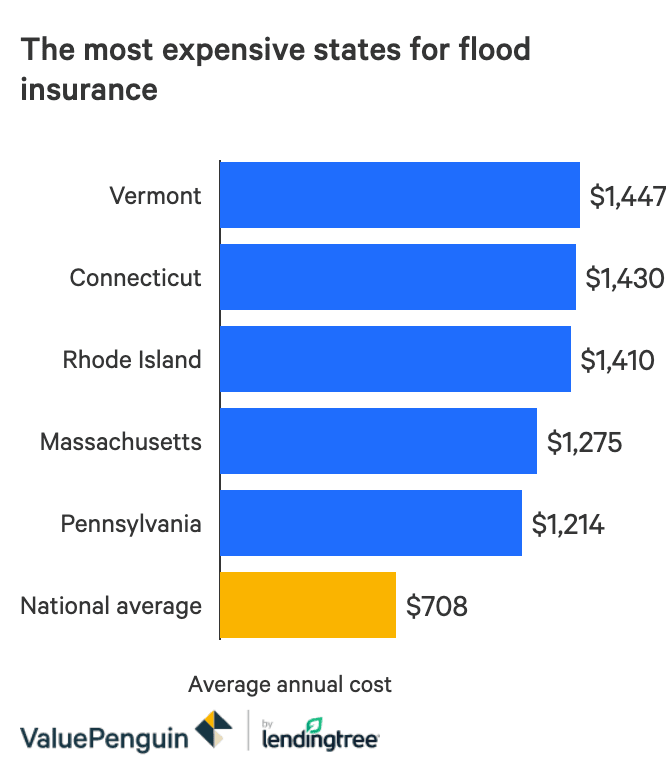

They are both optional for many homeowners and must be purchased separately.

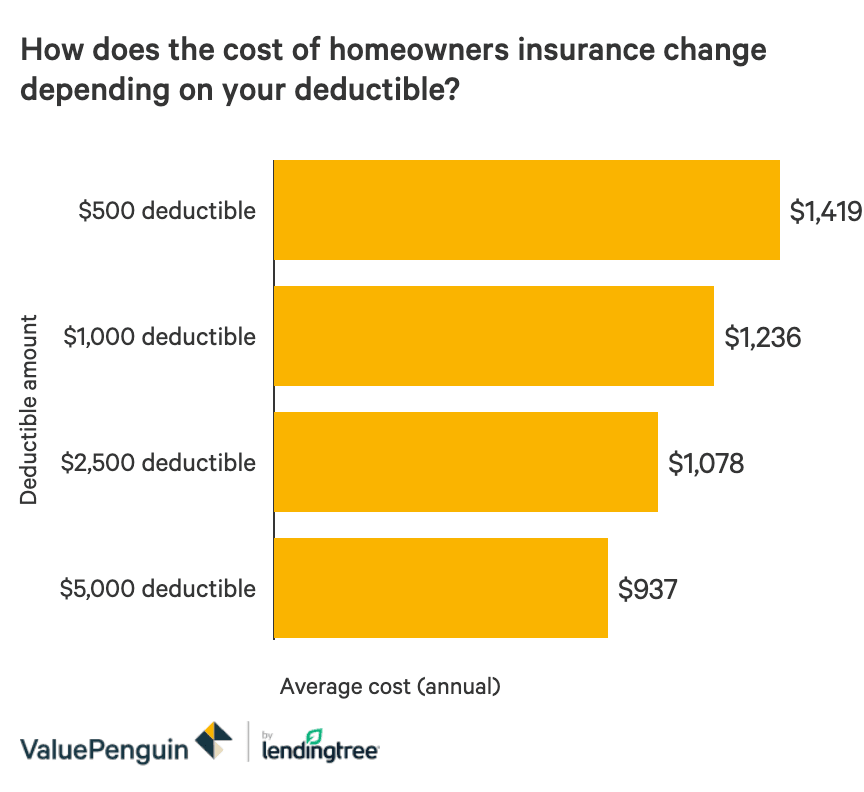

The value of your home where you live and the coverage level you choose can all impact the.

If you pay for home insurance through an escrow account your mortgage lender might pay your home insurance premiums yearly on your behalf.

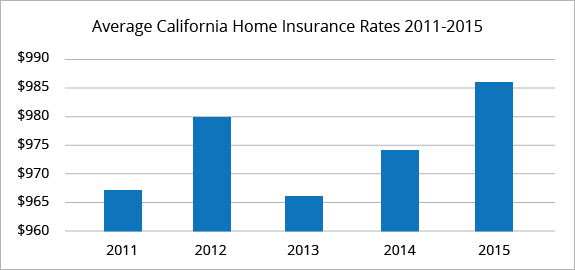

Our average home insurance data table below explains the average premium increases year over year.

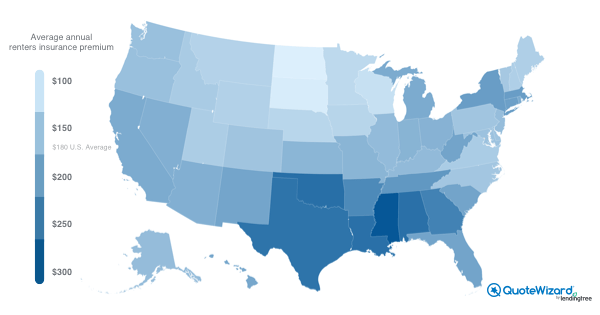

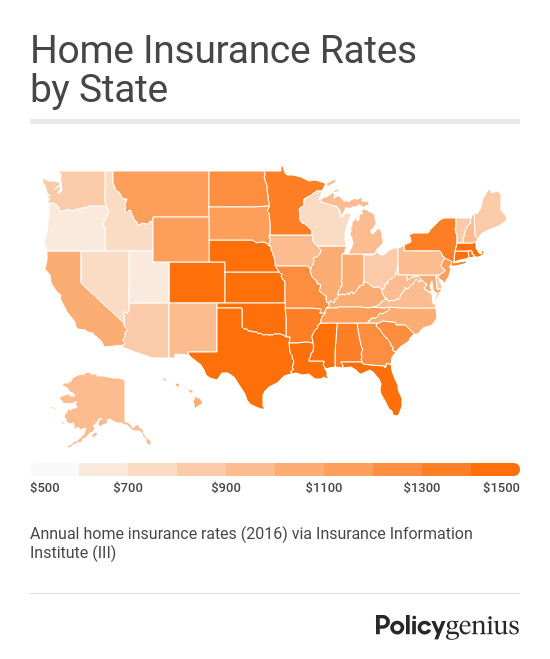

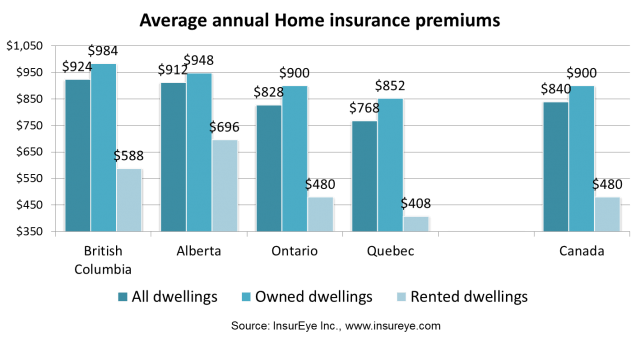

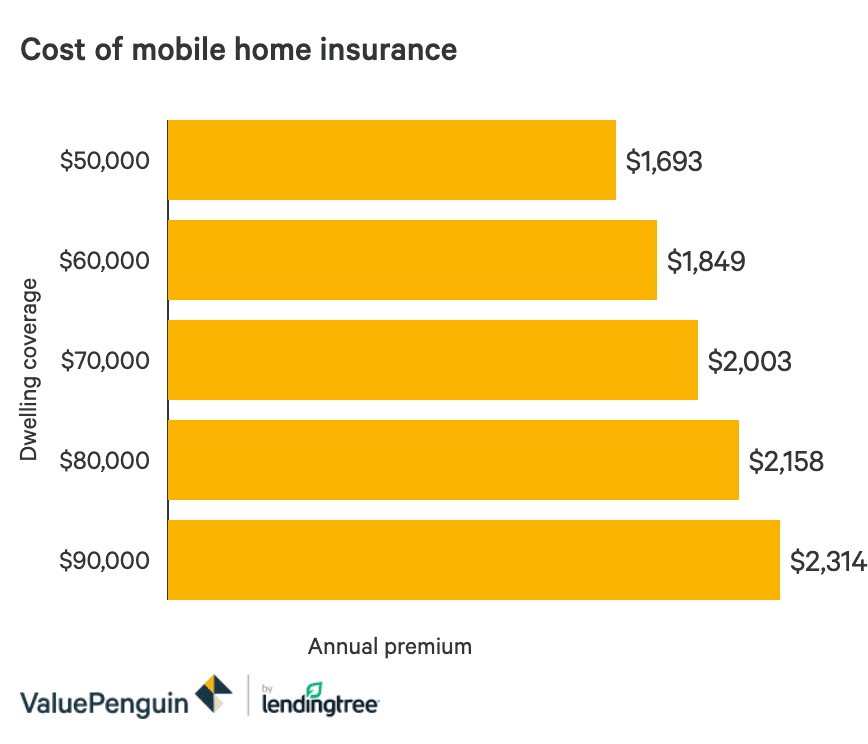

Depending on where you live the average cost of home insurance can fall anywhere between 400 and 3 000 per year.

The annual home insurance cost of 1 144 is a statewide average and doesn t include coverage for flooding and earthquakes.

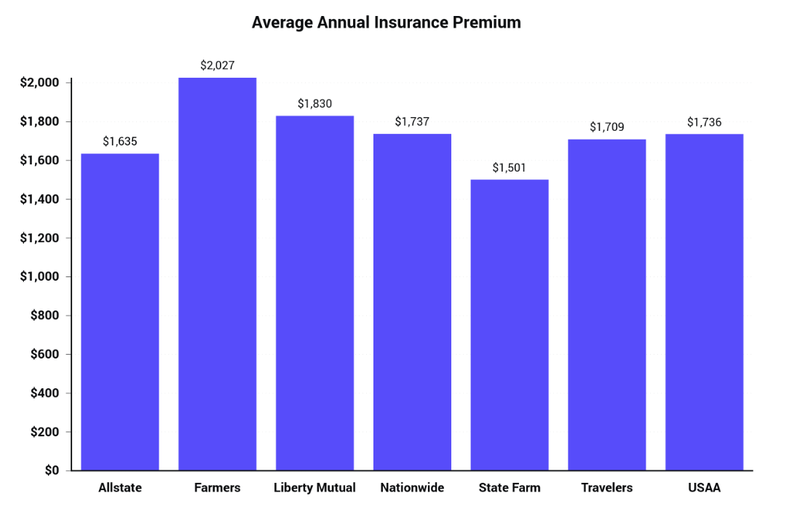

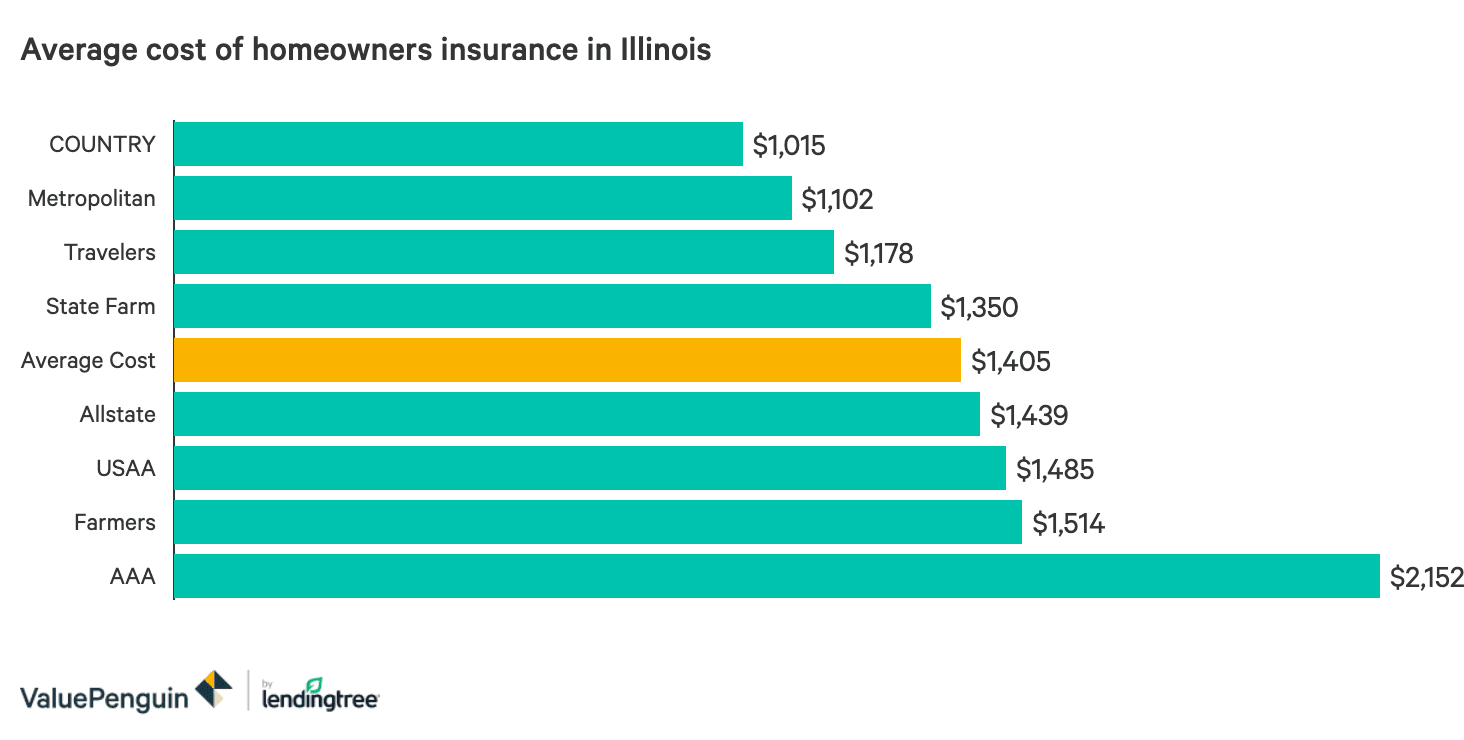

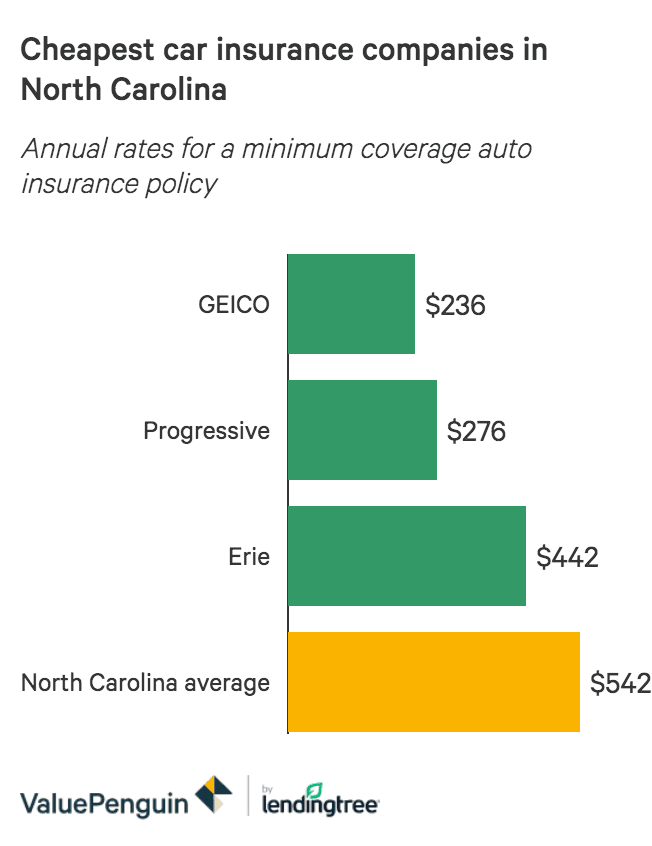

When shopping for home insurance you want to do more than just compare average homeowners insurance rates.

After all how you re treated when you file a claim is priceless.

Louisiana has the most expensive home insurance at an average of over 1 900 a year and oregon has the cheapest average home insurance at around 650 a year.

Average homeowners insurance cost by state.

By michelle megna updated on september 14 2020.

The average homeowners insurance premium in the united states is 1 211 a year according to the naic.

The average home insurance cost per month is 99 33 according to the national association of insurance commissioners 2018 home insurance report.

Average home insurance rates by zip code.

The average cost of homeowners insurance is around 1 200 a year but many factors play a role including the details of your property and which state and city you live in.

The highest homeowners insurance rates in the nation belong to zip code 33070 home to islamorada village of islands on plantation key florida.

Keep reading if you want to learn more about the true cost of homeowners insurance.

Health insurance premiums have risen dramatically over the past decade.

Review customer satisfaction to find the best home insurance companies.

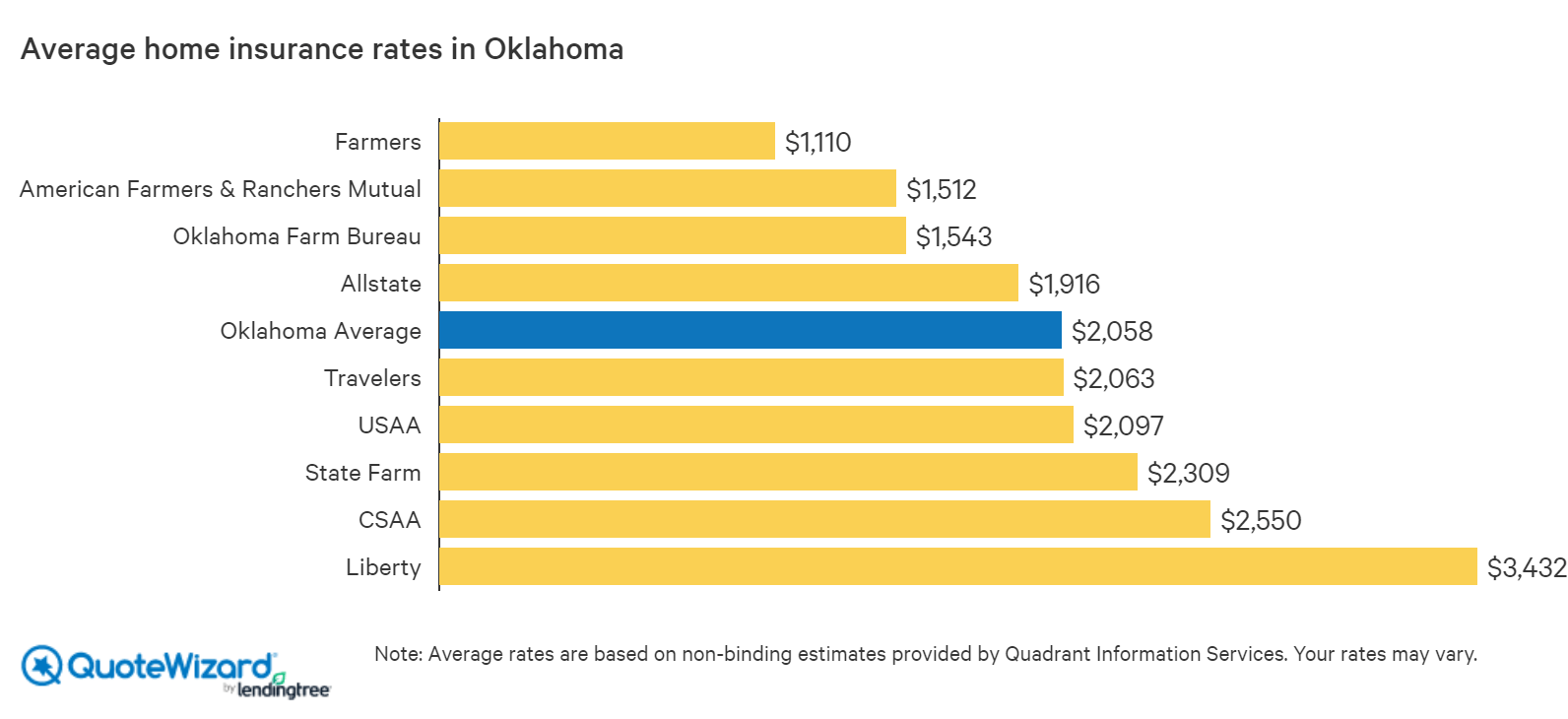

According to our findings homeowners premiums vary widely in each state.